Jesse Schneider, Grid Strategies LLC

August 14, 2019 (Updated November 12, 2020)

Transmission congestion costs significantly increased from 2016 through 2018 across the Regional Transmission Organizations or Independent System Operators (RTOs/ISOs) that serve around 58% of U.S. electricity customers. In 2019, congestion costs fell below 2016 levels. Of the seven operators of wholesale electricity markets in the country, all except the California Independent System Operator (CAISO) publicly post congestion cost data.

Figure 1: RTO/ISO Regions

As shown in the table below, reported congestion costs increased by 11% from 2016 to 2017, and by 21% from 2017 to 2018. In 2019, reported congestion costs decreased by approximately 30% compared to 2018 levels:

Table 1: Transmission Congestion Costs ($ millions) for RTOs from 2016-2019

| RTO | 2016 | 2017 | 2018 | 2019 |

| ERCOT | 497 | 976 | 1,260 | 1,100 |

| ISO-NE | 39 | 41 | 65 | 33 |

| MISO | 1,400 | 1,500 | 1,400 | 900 |

| NYISO | 529 | 481 | 596 | 462 |

| PJM | 1,024 | 698 | 1,310 | 583 |

| SPP | 280 | 500 | 450 | 457 |

| Total | 3,769 | 4,196 | 5,080 | 3,535 |

Transmission congestion occurs when there is insufficient transmission capacity to deliver lower-cost generation resources to consumers, requiring the use of higher-cost generators closer to customers. This increases the price of electricity in congested areas, as reflected in higher locational marginal prices and higher electricity prices for consumers.

Even with the omission of congestion costs in the CAISO region* and the one-third of U.S. consumers who are not served by RTOs, these high costs reflect the challenges that face the U.S. power grid, which are ultimately paid for by American households and business each year. To estimate a national congestion cost figure that includes the one-third of the country that does not have transparent congestion pricing, one can scale the known RTO/ISO congestion costs in Table 1 according to the peak load of the same regions and compare that to total U.S. load. Table 2 uses this peak load comparison to estimate that 58% of the country is covered by the six markets with transparent congestion cost data while 42% is not:

Table 2: Transparent Market Size in Relation to Entire U.S.

| Region | 2019 Peak Load (GW) |

| ERCOT | 75 |

| ISO-NE | 24 |

| MISO | 121 |

| NYISO | 32 |

| PJM | 151 |

| SPP | 51 |

| U.S. | 786 |

| % Covered | 58% |

If it is assumed that congestion outside of these transparent markets is similar to congestion within them, dividing annual congestion costs totals from Table 1 by .58 from the above approximates that annual U.S. transmission congestion costs totaled $6.4 billion in 2016, $7.2 billion in 2017, $8.8 billion in 2018, and $6.1 billion in 2019. This is likely to be a reasonable if not conservative estimate, as the price transparency and generally more favorable transmission expansion policies in the RTO regions should tend to reduce congestion in those areas relative to non-RTO regions. However, RTO regions have experienced more renewable deployment in recent years than non-RTO areas, which may somewhat offset those factors as renewable expansion tends to increase transmission congestion when it outpaces transmission expansion.

A closer look at the changes in congestion costs over the years identifies a few key drivers in congestion trends. ISO-New England, for example, found transmission expansion projects to be a major factor in congestion cost reduction. The ISO notes that 10 major transmission projects totaling $8 billion assisted in congestion cost decreases from over $250 million in 2002 to under $50 million annually starting in 2009, where congestion costs generally remained until an increase to $64.5 million in 2018. Similarly, MISO attributes nearly half of the 35% reduction in congestion costs from 2018 to 2019 to new transmission and line upgrades.

Some of the transmission cost increases in 2018 can be attributed to the Bomb Cyclone in January 2018, which affected much of the Northeastern U.S. New York real-time congestion values, for example, increased from $79 million in the first quarter of 2017 to $202 million in the first quarter of 2018.

In PJM, congestion costs in the first half of 2018 tripled to nearly $900 million relative to a year earlier. This reflected that during the Bomb Cyclone event in January 2018, the low temperatures were far more extreme in eastern PJM than in western PJM, causing wholesale electricity prices in eastern PJM to be about three times higher than in western PJM. Specifically, during the Bomb Cyclone week, power prices in Virginia averaged about $222/MWh, versus $76/MWh in Northern Illinois. Greater west-to-east transmission capacity in PJM, and an ability to import more power from MISO, would have saved PJM consumers hundreds of millions of additional dollars during the Bomb Cyclone event alone.

Forecasting long-term congestion has proven to be a difficult task; however, there are a handful of signals that suggest congestion costs may continue to rise without any intervention. The first of these signals includes the projected $2.8 billion decrease in transmission investment from 2018 through 2021. This decrease, alongside the existing policy barriers associated with siting and planning regional and interregional transmission, may serve to reduce the amount of transmission built in the near future. The North American Electric Reliability Corporation (NERC) finds that while 10,017 circuit miles of planned transmission lines are expected to be completed in NERC assessment areas by 2020, this number drops dramatically by between 2021 and 2025 when only 1,248 circuit miles of planned transmission are expected to be completed.**

Transmission expansion reduces congestion by facilitating a more efficient transfer of load across the lines, especially in areas where congestion historically exists. The congestion-reducing abilities and other benefits of transmission expansion projects have been noted by a number of RTOs. In addition to the analysis from ISO-New England above, another retrospective transmission analysis from SPP finds that recent transmission expansion projects installed between 2012 and 2014 are expected to generate over $10 billion in net benefits for consumers and approximately $16 billion in production costs savings over the next 40 years. A comparison between total quantified benefits and the costs of transmission expansion results in a Benefit-to-Cost ratio of 3.5. Figure 2 below shows the benefits, as represented in the stacked column to the left, are expected to increase over time while costs, as represented in the orange columns, decline:

Figure 2: SPP Transmission Expansion Benefits and Costs from 2014-2023

Additionally, one forward-looking PJM analysis finds that transmission enhancements approved between 2014 and 2023 will reduce costs to customers by over $280 million annually by alleviating congestion, in addition to the estimated congestion savings of approximately $100 million from the first four years of operation of five interregional projects. MISO has also estimated that the transmission upgrades currently underway in the region are expected to yield $12 to $53 billion in net benefits over the next 20 to 40 years, with congestion and fuel savings estimated to total between $20 and $71 billion.

With a decline in expected transmission investment on the horizon, renewable capacity on the other hand is expected to continue to expand. Renewables expansion without transmission expansion to facilitate integration onto the grid tends to increase congestion and renewable curtailment, which occurs when transmission congestion is so extreme that wind or solar plant output must be reduced. As shown below, wind curtailment increased earlier this decade in ERCOT, SPP, and MISO as wind additions outpaced transmission expansion. However, as those regions have since added transmission, congestion and wind curtailment has decreased.

Figure 3: Wind Curtailment and Penetration Rates by ISO

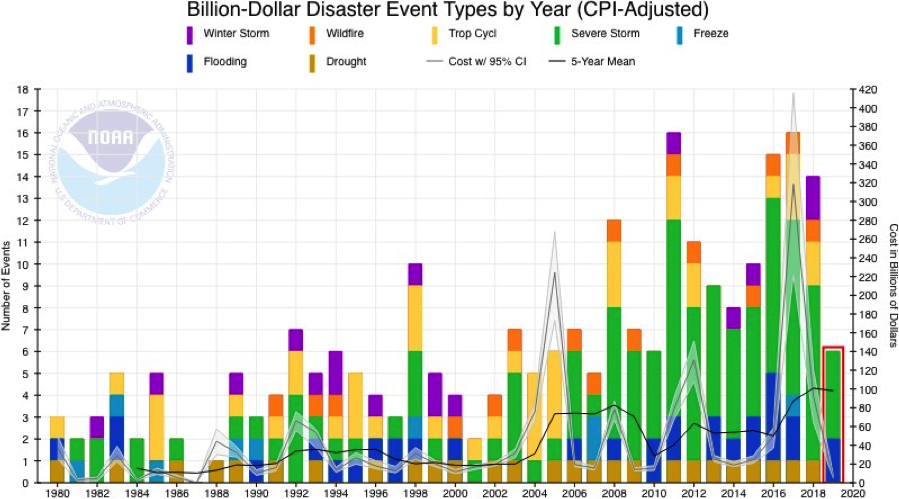

Additionally, the question remains of whether or not extreme weather events like the Bomb Cyclone are to be considered an anomaly or the new normal due to climate change. According to the National Centers for Environmental Information (NOAA), the frequency and cost of environmental disaster events has increased dramatically since the 1980s:

Figure 4: Environmental Disaster Events from 1980-2018

As extreme weather events increase in cost, frequency, and magnitude, major power system failures and instances of congestion are likely to increase as well without transmission expansion.

###

*For reference, the most recent public account of congestion costs in CAISO was included the U.S. Department of Energy’s National Electric Transmission Congestion Study. Based on personal communications with the ISO, DOE reported total congestion costs to be above $0.5 billion in 2018. Because DOE’s report only reports CAISO congestion costs through 2018 and provides a graph without firm annual cost figures, we exclude CAISO from our analysis.

**Note: The planned transmission projects that are expected to be completed by 2020 and between 2021-2025 are located in NERC assessment areas, which extend into Canada. Additionally, these numbers only include planned projects which “refers to projects where the line is included in a regional transmission plan, or where (a) permits have been approved; (b) a design is complete; or (c) the project is necessary to meet a regulatory requirement.” These do not include Conceptual lines which are “those that are in a project queue, but not included in a transmission plan, or where (a) a line is projected in the transmission plan; (b) a line is required to meet a NERC TPL Standard or powerflow model and cannot be categorized as “Under Construction” or “Planned”; or (c) projected lines that do not meet the requirements of “Under Construction” or “Planned.” See Annual U.S. Transmission Data Review.

Appendix A: Sources for Table 1 – Transmission Congestion Costs ($ millions) for RTOs from 2016-2018

ISO-NE (2017), 2016 Annual Markets Report, May 30, 2017, https://www.iso-ne.com/static-assets/documents/2017/05/annual_markets_report_2016.pdf, p. 90.

ISO-NE (2018), 2017 Annual Markets Report, May 17, 2018, https://www.iso-ne.com/static-assets/documents/2018/05/2017-annual-markets-report.pdf, p. 84.

ISO-NE (2019), 2018 Annual Markets Report, May 23, 2018, https://www.iso-ne.com/static-assets/documents/2019/05/2018-annual-markets-report.pdf, p. 91.

ISO-NE (2020), 2019 Annual Markets Report, May 2020, https://www.iso-ne.com/static-assets/documents/2020/06/a6_2019_annual_markets_report.pdf, p. 96.

Monitoring Analytics (2018), State of the Market Report for PJM, March 8, 2018, https://www.monitoringanalytics.com/reports/PJM_State_of_the_Market/2017/2017-som- pjm-volume2.pdf, p. 503.

Monitoring Analytics (2019), State of the Market Report for PJM, March 14, 2019, https://www.monitoringanalytics.com/reports/PJM_State_of_the_Market/2018/2018-som- pjm-volume2.pdf, p. 512.

Monitoring Analytics (2020), State of the Market Report for PJM, March 13, 2020, https://www.monitoringanalytics.com/reports/PJM_State_of_the_Market/2019/2019-som-pjm-volume2.pdf, p. 518

Potomac Economics (2017a), 2016 State of the Market Report for the ERCOT Electricity Markets, May 2017, https://www.potomaceconomics.com/wp-content/uploads/2017/06/2016-ERCOT- State-of-the-Market-Report.pdf, p. i.

Potomac Economics (2017b), 2016 State of the Market Report for the MISO Electricity Markets, June 2017, https://www.potomaceconomics.com/wp-content/uploads/2017/06/2016- SOM_Report_Final_6-30-17.pdf, p. x.

Potomac Economics (2017c), 2016 State of the Market Report for the New York ISO Electricity Markets, May 2018, https://www.potomaceconomics.com/wp- content/uploads/2018/06/NYISO-2017-SOM-Report-5-07-2018_final.pdf, p. 9.

Potomac Economics (2018a), 2016 State of the Market Report for the ERCOT Electricity Markets, May 2018, https://www.potomaceconomics.com/wp-content/uploads/2018/05/2017-State-of- the-Market-Report.pdf, p. i.

Potomac Economics (2018b), 2017 State of the Market Report for the MISO Electricity Markets, June 2018, https://www.potomaceconomics.com/wp-content/uploads/2018/07/2017-MISO- SOM_Report_6-26_Final.pdf, p. vi.

Potomac Economics (2018c), 2017 State of the Market Report for the New York ISO Electricity Markets, May 2019, https://www.potomaceconomics.com/wp- content/uploads/2019/05/NYISO-2018-SOM-Report Full-Report 5-8-2019_Final.pdf, p. 8.

Potomac Economics (2019a), 2016 State of the Market Report for the ERCOT Electricity Markets, June 2018, https://www.potomaceconomics.com/wp-content/uploads/2019/06/2018-State-of- the-Market-Report.pdf, p. i.

Potomac Economics (2019b), 2016 State of the Market Report for the MISO Electricity Markets, June 2019, https://www.potomaceconomics.com/wp-content/uploads/2019/06/2018-MISO- SOM_Report_Final2.pdf, p. vi.

Potomac Economics (2020a), 2019 State of the Market Report for the ERCOT Electricity Markets,May 2020, https://www.potomaceconomics.com/wp-content/uploads/2020/06/2019-State-of-the-Market-Report.pdf, p. 47.

Potomac Economics (2020b), 2019 State of the Market Report for the MISO Electricity Markets, June 2020, https://www.potomaceconomics.com/wp-content/uploads/2019/06/2018-MISO- SOM_Report_Final2.pdf, p. xii.

Potomac Economics (2020c), 2017 State of the Market Report for the New York ISO Electricity Markets, May 2020, https://www.nyiso.com/documents/20142/2223763/NYISO-2019-SOM-Report-Full-Report-5-19-2020-final.pdf/bbe0a779-a2a8-4bf6-37bc-6a748b2d148e?t=1589915508638, p. 9.

SPP (2017), State of the Market 2016, August 10, 2017, https://www.spp.org/documents/53549/spp_mmu_asom_2016.pdf, p. 6.

SPP (2018), State of the Market 2017, May 8, 2018, https://www.spp.org/documents/57928/spp_mmu_asom_2017.pdf, p. 1.

SPP (2019), State of the Market 2018, May 15, 2019, https://www.spp.org/documents/59861/2018%20annual%20state%20of%20the%20market%2 0report.pdf, p. 2.

SPP (2020), State of the Market 2019, May 11, 2020, https://www.spp.org/documents/62150/2019%20annual%20state%20of%20the%20market%20report.pdf, p. 2.

Appendix B: Sources for Table 2 – Transparent Market Size in Relation to Entire U.S

ERCOT (2020), 2020 ERCOT System Planning Long-Term Hourly Peak Demand and Energy Forecast, December 31, 2016, http://www.ercot.com/content/wcm/lists/196030/2020_LTLF_Report.pdf, p. 2.

ISO-NE (2019), “Net Energy and Peak Load by Source,” September 20, 2019, https://www.iso-ne.com/static-assets/documents/2019/02/2019_energy_peak_by_source.xlsx.

NYISO (2020), 2020 Load and Capacity Data “Gold Book,” April 2020, https://www.nyiso.com/documents/20142/2226333/2020-Gold-Book-Final-Public.pdf, p. 13.

PJM (2019), PJM Load Forecast Report, January 2019, https://www.pjm.com/-/media/library/reports-notices/load-forecast/2019-load-report.ashx, p. 4.

Potomac Economics (2020), 2019 State of the Market Report for the MISO Electricity Markets, June 2020, https://www.potomaceconomics.com/wp-content/uploads/2019/06/2018-MISO- SOM_Report_Final2.pdf, p. 8.

SPP (2020), State of the Market 2019, May 11, 2020, https://www.spp.org/documents/62150/2019%20annual%20state%20of%20the%20market%20report.pdf, p. 26.

U.S. Energy Information Administration (EIA) (2018), “Noncoincident Peak Load, by North American Electric Reliability Corporation Assessment Area, 1990-2016 Actual, 2017-2027 Projected,” https://www.eia.gov/electricity/data/eia411/pdf/peak_load_2016.pdf

—–Jesse Schneider is a Research Analyst at Grid Strategies LLC